Labelbox•February 26, 2021

Why insurance AI needs a training data platform

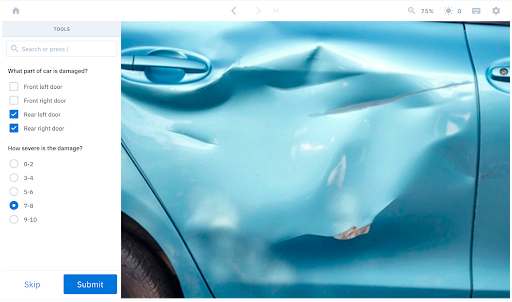

A recent article in Towards Data Science, “How is AI impacting the insurance industry?” data scientist Roman Orac stated that insurance companies have recently been expanding the use of AI far beyond its initial role in claims automation. At Labelbox, we’ve seen our insurance customers train models on aerial imagery for risk assessment and catastrophe modeling, use photos from mobile devices to find information related to accidents, and much more.

“Auto insurers, from Progressive to Geico, are using telematics to collect real-time driving data from vehicles, rewarding safe drivers with discounts and helping reconstruct accidents. Wearables such as fitness trackers and heart rate monitors may eventually help health insurers track and reward healthy habits such as regular exercise,” says Orac.

The key factor to enabling production-ready computer vision models in an insurance enterprise is — you guessed it — a training data platform. Annotating the millions of images necessary to train these models while ensuring accuracy, security, and speed is a challenge that has prevented many enterprise AI efforts from reaching production. Labelbox empowers insurance AI teams at Cape Analytics, Arturo, Allstate, and others to streamline their annotation process with built-in queueing, quality management, ontology management, and more.

Perhaps most importantly, using a training data platform ensures that the training data remains with the enterprise throughout the process. “By using a platform rather than a ‘black-box service provider,’ who takes data and returns it labeled, these companies say they retain control of its most important IP,” says Orac of the insurance enterprises that leverage Labelbox.

Want to learn more about how you can accelerate your insurance AI efforts? Read our guide, Why insurance AI requires a training data platform.

All blog posts

All blog posts